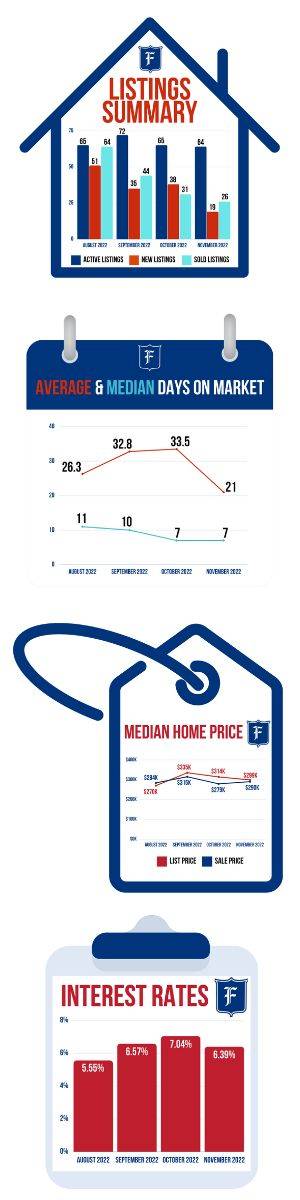

We received a welcome reprieve after 10 months of steadily increasing interest rates, prospective homebuyers got some good news in November. Interest rates have reversed their year-long trend of steadily increasing and dipped back down. Rates are expected to continue to decrease as the Federal Reserve apparently continues to get inflation more under control.

“Thanks to the rate-friendly inflation data, mortgage rates dropped back below 7%,” said Nadia Evangelou, senior economist and director of forecasting for the National Association of Realtors. “It seems that the higher federal funds rates are starting to cool off inflation. And, if inflation continues to decelerate over the next several months, mortgage rates will likely stabilize below 7%.”

The decreasing interest rate will help continue to fuel buyer action as the average days on market dipped down to 21 days and the median days on market stayed steady at seven days.

Ames is still dealing with extremely low inventory, which has persisted throughout the entire year. The market tends to slow down during the winter months and just 19 new homes were introduced in November. Demand remains high for houses, so if you’ve thought about selling, reach out to your Friedrich agent to get the process started.

If you’re a buyer but are intimidated by the higher interest rates, talk with your Friedrich agent about purchasing “buy down points” from your lender, which helps buyers lower their interest rate and increase their buying power. Let us help you buy or sell your home the Friedrich way!

|